Our Core Investing Beliefs

Invest in Real Companies You Don’t Manage

Wealth is created when people come together and work to create goods and services that improve quality of life, such as homes, transportation, better medical care and food.

This collective work is organized into companies, or "businesses." These businesses—the collective efforts of people—are the source of all economic growth and development.

To profit from this growth, you can:

1. Get a job and contribute your own labor

2. Loan money to these businesses (i.e. buy "bonds")

3. Own these businesses (i.e. buy shares of stock)

In addition to owning your own practice (your job), you can put your money to work "passively" by buying ownership in companies you don't manage. By supplying your capital, you can literally own part of this great economic engine.

Understand Your Long-Term Investment Plan

Most people think the goal of investing is to buy low, cross your fingers, and hope to sell high on some magical day in the future—the day you retire.

Compare your investment strategy to a farmer who is buying and planting orange trees (stocks). The plan is not to buy a bunch of trees to then sell them in the future. The plan is to get enough trees planted so that the farmer can live off the oranges those trees produce!

Likewise, as a business owner you are entitled to your "share" of the company's profits, called a dividend. Rather than sell, the real goal is to buy as many shares (trees) as possible and hold those shares, possibly forever, living on the passive income (oranges) they generate.

Leverage

Financial Science

At PFG Investments, we leverage the most rigorously tested academic analysis and strategy available, much of which was pioneered by the research of eleven Nobel Laureates and other innovators in investment and behavioral finance.

While the future of finance can never be predicted with certainty, using academic research as a tool when making long-term investment decisions can help us identify recurring trends and better understand the attitudes and emotions involved with investing.

Believe in the

Power of Markets

The term “markets” refers to a place where people come to buy and sell, to trade and do business. We believe that the collective efforts of these people—with different and specialized skills, interests, and abilities—have and will continue to reward investors who provide capital to fuel market growth.

Rather than rolling the dice and trying to pick individual winners and losers, we believe that the probability of success increases when you can capture entire market returns with low-cost, institutional mutual funds that invest in thousands of different companies.

Our Investing Methods

Asset Class Investing

Risk and return go hand in hand; the more risk you take, the more return you can expect.

We allocate money to asset classes that have higher or lower expected risk and return factors to help you balance both sides of that equation.

Tax Efficiency

As you find yourself in higher tax brackets, it becomes increasingly important to know how to keep and grow your money after taxes. We take a comprehensive tax planning approach with a dual focus on minimizing taxes on both earned income and investment income.

We begin by considering the best type of accounts for you to own, including which assets to own within each account.

Diversification

Diversification is much more than “not putting all your eggs in one basket.” Tied closely to asset class investing, an effectively diversified portfolio will utilize asset classes with different risk and return profiles to maximize return possibility, while simultaneously minimizing risk.

Rebalancing

Fluctuating markets will cause a portfolio’s investments to drift away from their original target allocations. Rebalancing brings your investments back to their original targets by selling assets that are overweight and buying assets that are underweight, allowing you to retain your preferred risk and expected return profile. Additionally, through rebalancing, we can systematically buy low and sell high.

Helping You Manage Behavior

A good investment advisor is like hiring a personal trainer. Yes, they will give you better workout ideas, and yes, they may even bring you a towel and water bottle; but most importantly, with the trainer’s help, you will show up and finish the workout, ultimately becoming stronger and healthier. The best athletes have trainers for this reason: to keep them accountable.

Likewise, the best investors, with the most money invested, have advisors who will help them make good decisions and stay the course. Sustained performance with investment management requires doing the right things over and over—like investing more money and staying invested— especially when the circumstances are most difficult, like the next time the market is falling.

As your advisor and fiduciary, we help you live intentionally with your finances. Those who work with us will likely save more money, make better financial decisions, stay the course with their financial plan, and ultimately end up with more money and in a much better financial situation overall.

Refine Your Financial Plan

Like a coach develops a game plan that gives their team the best chance to win, we do the work to identify your strengths and then guide you toward taking full advantage of what will help you find the most success.

Every investment decision we make on your behalf considers your unique financial and life plan. Ultimately, your choices about what you want from life will influence your plan the most.

If you are ever in doubt about your plan, refer to your Playbook (our name for your financial plan) or call us.

Your plan is written out and given to you, so the decisions made about your investments are fully transparent and you can see the details at any time. If you have any questions at all, we want you to reach out so we can answer them and set your mind at ease.

Keep Emotions in Balance

Successful investors share three traits:

Faith in the future, Patience, and Discipline.

Investing presupposes faith in the future. When you plant a seed, you expect it to grow. The best investors not only believe the future will be better, but their money fuels the growth that makes that better future possible.

Like growing trees, investing is a long, slow (sometimes painfully so) process. The best investors also happen to be the most patient.

You cannot control the markets, but you can control your reaction to natural market cycles and your personal finances—like cash flow, debt, and how much you save and spend.

A disciplined approach to investing will protect you from irrational financial decisions and will give you the strength to follow your investing plan, regardless of the weather or news of the day.

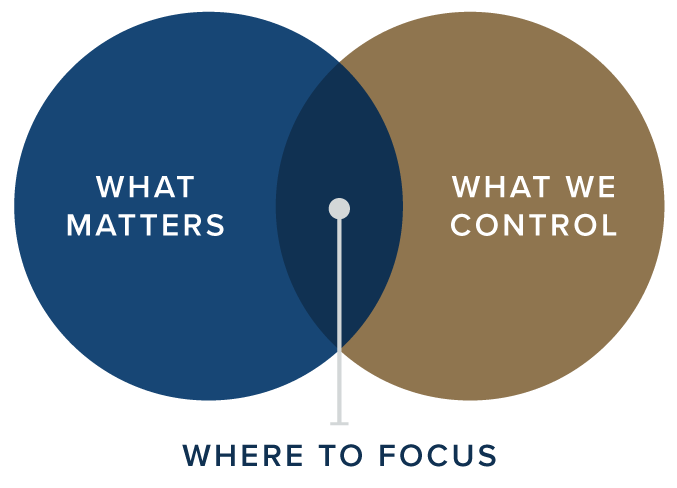

Focus on the area between what you decide matters

the most and what you can control.

In life, there are things that matter and things that don't matter. There are also things we can control and things outside of our control. In summary, our mission is to have a relentless focus on every part of your financial life that matters and that we can control.

Additional Resources

Introducing the 401(k)

Our Interests Are Aligned

Applying Science to Investing

A Foundation Built on Great Ideas

Mutual Fund Landscape