Enroll in the plan or update your information here:

401(k) plans managed by PFG Investments are set up as “pooled accounts.” this means that you are invested with your coworkers (including the doctor) in a single account at Charles Schwab.

Because your plan is set up as a pooled account…

- You will not be able to log in or check your account balance in real-time.

- You will receive an annual statement showing your account balance as of December 31st of the prior year.

- With hundreds of plans to reconcile, these statements are not typically available until the spring or summer each year.

Why is your plan set up that way?

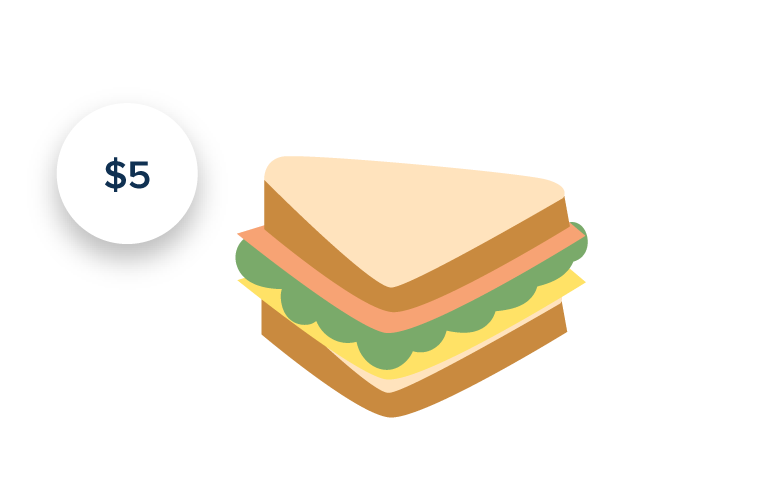

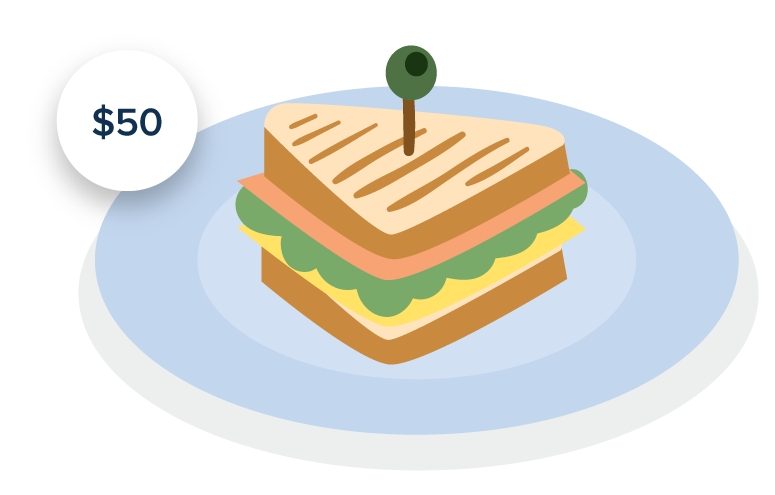

- Lower costs. Shared costs mean lower costs. When you pay lower fees today, you keep more saved and invested for retirement.

- Professional money management. Everyone participant’s money (both employees and doctors) is professionally managed, giving you the best chance for long-term success.

The images to the left show the same exact sandwich but at very different costs!

The pooled 401(k) plan is actually a common structure, including the way we manage our own 401(k) plan at Practice Financial Group. However, remember that you are not obligated to participate in the plan. The plan is a generous but optional benefit provided by your employer.

If you’re someone who likes to check your investment balance regularly (not recommended), or someone who wants complete control to invest in Bitcoin or individual stocks (also not recommended), this 401(k) plan may not be right for you.

If your goal is to maximize the probability of long-term financial success, this will be an ideal investing vehicle for you.